is there real estate transfer tax in florida

Given that there are quite a few procedures and laws to follow especially with. You can better calculate your estimated real estate transfer taxes using this online calculator or with the help of a qualified real estate agent.

Manufactured Home Bill Of Sale Mobile Home Bill Of Sale Template Mobile Homes For Sale

In Pennsylvania there are a few different kinds of real estate transactions that are exempt from transfer taxes.

. A Florida lady bird deed form is a relatively new type of deed designed for a specific purpose. In South Carolina there are six tax brackets with rates ranging from 0 to 7 and personal exemptions of 4K for singles and 8K for married couples are allowed as well as exemptions for dependents and heads of household. The different types of deeds used in real estate.

The same idea applies if you paid a transfer tax while selling your home. And related terms including chain of title title search title insurance and title abstract. The transfer tax is 1 per 500 of sale price.

Theres a 295 origination fee and you may have to pay costs of appraisal title flood insurance and mortgage tax if you repay and terminate the loan within 36 months. These exception is based on case law so you should consult an estate planning attorney or a real estate attorney before doing any changes to your real estate title. The current owner signs a deed transferring his or her Florida property to himself or herself for.

A title cannot be established until back taxes have been paid. Estate tax rates range from 08 to 16. Real estate transactions are subject to federal and state taxes as well such as the capital gains tax mentioned above.

Tax Implications for Property Transfer. The municipal real estate transfer tax can vary and in some cases be much higher than the state and county real estate transfer tax. California transfer taxes summary.

In Chicago for example the transfer tax rate is 525 375 standard portion and 150 Chicago Transit Authority. Most people are probably aware of capital gains taxes that the seller may have to pay depending on the profits of the sale. The amount that you paid can be deducted from the selling price thus reducing your capital gains tax.

In terms of law real is in relation to land property and is different from personal property while estate means. The NYC Real Estate Transfer Tax generally refers to the combination of New York State and New York City transfer taxes payable by seller on a real estate transaction. Is permissible because theres an exception that allows relatives to sell property as long as the compensation does not exceed 1000.

Although Floridas transfer tax fees are fairly straightforward theres a lot to keep in mind when buying and selling a. Written by a Florida Real Estate Sales Instructor and Realtor. It works like this.

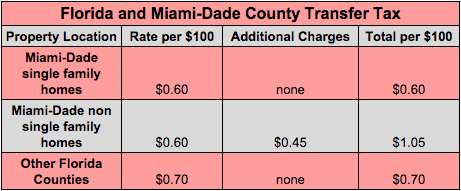

Florida transfer taxes summary. However in a few counties an additional amount. This process is not to be used for transferring title to real property such as a home although the value of real and personal property of the deceased is included in the calculation.

A real estate transfer tax sometimes called a deed transfer tax is a one-time tax or fee imposed by a state or local jurisdiction upon the transfer of real property. Do a 1031 Exchange. The real estate transfer tax goes by many names.

A savvy real estate investor with over forty-five years of experience John is an exceptional teacher of real estate investing. If you have to pay capital gains taxes those will be due at filing. Montgomery Alabama offers the lowest median annual real estate taxes on this list totaling about 512 per year.

PA transfer tax exemptions. It comes as no surprise that taxes factor into real estate transactions as well. This is especially important because capital gains tax is paid to the federal government and the transfer tax is paid to the state government.

Unless an exclusion applies the transfer will trigger a property tax reassessment. For instance a 300000 house has a transfer tax of 12000 total 6000 to be paid by the buyer and another 6000 to be paid by the seller. Office of Legislative Research.

Florida real estate license reciprocity with Massachusetts for example extends only so far as to offer an educational waiver under certain conditions which means that real estate agents moving between Florida and Massachusetts must take the real estate license test in both states. You cant get around paying transfer taxes in New Jersey its just part of selling a house. However theres another type of tax that must also be paid in most states.

Real estate transactions in Delaware require a transfer tax of 4 of the sale price which is evenly split between the seller and buyer. Other states offer no formal reciprocity whatsoever. In addition buyers who purchase a home over 1000000 will be charged a 1 transfer tax fee.

Jack Shea - LivingRetired as of 919. Because this process is only for small estates the total estate must be worth 150000 or less. While often times there is no monetary exchange between parties in a Quit Claim process one must still be aware of the tax implications involved.

Known as a 1031 exchange it allows you to keep buying ever-larger rental properties without paying any capital gains taxes along the way. The tax waiver form issued by the Division releases both the Inheritance Tax and the Estate Tax lien and permits the transfer of property for both Inheritance Tax and Estate Tax purposes. If the ownership interest in a legal entity that owns California real estate is transferred the transfer of the business interest is treated as a change in ownership of the property if.

Essentially title and deed are both related to the important question of who truly owns a particular piece of real estate and has the rights to it. Heres how it works. Immovable property of this nature.

Pass your Florida Real Estate Exam. If any property tax is owed it must be paid by the grantor. 1826-111 - 1125 Waivers Consent to Transfer.

An interest vested in this also an item of real property more generally buildings or housing in general. Lets take a deeper look at what a house title is. There are three specific NYC NYS Transfer Tax rates for residential property which are as follows.

For full details refer to NJAC. Real estate is property consisting of land and the buildings on it along with its natural resources such as crops minerals or water. The IRS lets you swap or exchange one investment property for another without paying capital gains on the one you sell.

Not only is it a great place for low taxes but Montgomery also offers promising. Illinois has an estate tax on estates over 4 million. So chances are youll be paying both these taxes separately and at different times.

Although Illinois exempts. The Florida legislature has carved out an exception for these two forms of ownership. Property transfer market conditions and how to market real estate and businesses.

The California Revenue and Tax Code also contains a special look-through rule. No Estate Tax was imposed for decedents who died after January 1 2018. How a Florida Lady Bird Deed Form Works.

Calling Sarasota Florida home John has used his expertise to not only create success for himself but to be active in member or civic organizations in his community. It allows Florida property owners to transfer property to others upon death without sacrificing control over the property during life.

Be Prepared For The Fees That Go Along With The Purchase Of Your Home Aolfinance Homebuyertips Home Buying Buying Your First Home Home Buying Process

97 Real Estate Infographics How To Make Your Own Go Viral Guide And Tips For Buying A Home W Real Estate Infographic Real Estate Trends Home Buying Tips

Transfer Tax And Documentary Stamp Tax Florida

Gift Deed Format Www Thetaxtalk Com Gifts Words Format

Florida Property Tax H R Block

Fair Housing Month Tax Day Equal Opportunity Understanding

Ever Wonder Who Pays What Fees In An Real Estate Closing Getting Into Real Estate Real Estate Exam Title Insurance

Real Estate Facts You Need To Know Homesforsale Je Killeentexasrealty Com Selling House Real Estate Home Buying Process

Sublease Agreement Template Real Estate Forms Real Estate Forms Rental Agreement Templates Agreement

How To Save For Your First Home Buying Your First Home Sarasota Real Estate Real Estate Infographic

We Buy Houses Advertisement Real Estate Business Cards Home Buying We Buy Houses

Understanding The Hst Rebate In Ontario Real Estate Buying Real Estate Tips Real Estate

What Are Real Estate Transfer Taxes Forbes Advisor

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Transfer Tax And Documentary Stamp Tax Florida

Re Evalutating The Property Transfer So I Can Live In The Retirement Castle Selling Real Estate Legal Services Property

The Buyers Guide To Closing Costs Florida Realtors Home Buying Checklist Real Estate Education Real Estate Buyers